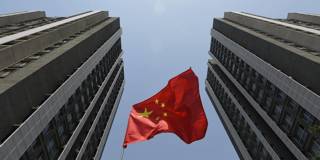

Even with rock-bottom interest rates, the COVID-19 pandemic has forced one vulnerable country after another to default on its external debt, or to signal that it may do so soon. Worse, the main foreign creditor to debt-distressed emerging economies, China, has little experience managing cascading sovereign defaults.

BISHKEK – Global indebtedness has never been greater than it is today. With interest rates so low for so long, anyone who could borrow has done so. But, even with rock-bottom borrowing costs, the economic fallout from the pandemic has forced one vulnerable country after another to declare sovereign default, or to signal that it may do so soon. Worse, the main creditor to debt-distressed emerging economies, China, has little experience managing cascading sovereign defaults.

BISHKEK – Global indebtedness has never been greater than it is today. With interest rates so low for so long, anyone who could borrow has done so. But, even with rock-bottom borrowing costs, the economic fallout from the pandemic has forced one vulnerable country after another to declare sovereign default, or to signal that it may do so soon. Worse, the main creditor to debt-distressed emerging economies, China, has little experience managing cascading sovereign defaults.