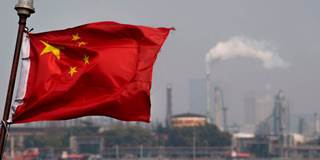

For the past decade, China’s strategy for internationalizing the renminbi has involved greater reliance on the IMF’s Special Drawing Rights as an alternative international reserve currency. But the launch of renminbi-denominated oil trading this year suggests that China will now pursue de-dollarization head-on.

SYDNEY/ITHACA – It is now just ten months since China launched its oil futures contract, denominated in yuan (renminbi), on the Shanghai International Energy Exchange. In spite of forebodings and shrill alarms, the oil markets continue to function, and China’s futures contracts have established themselves and overtaken in volume terms the dollar-denominated oil futures traded in Singapore and Dubai.

SYDNEY/ITHACA – It is now just ten months since China launched its oil futures contract, denominated in yuan (renminbi), on the Shanghai International Energy Exchange. In spite of forebodings and shrill alarms, the oil markets continue to function, and China’s futures contracts have established themselves and overtaken in volume terms the dollar-denominated oil futures traded in Singapore and Dubai.